asset protection, features

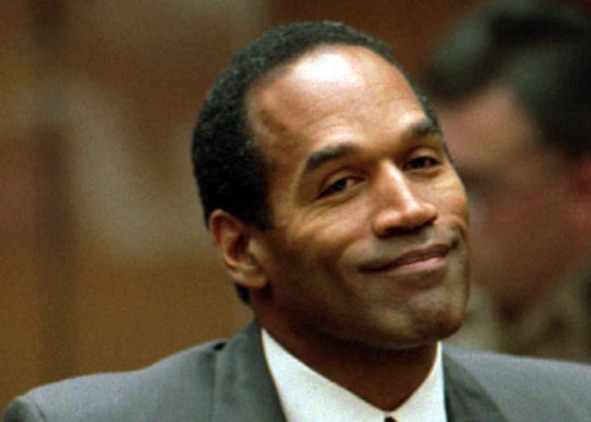

Asset Protection & Privacy: Lessons from the OJ Simpson Case

Jacob Stein, a tax and asset protection specialist with the law firm of Boldra, Klueger & Stein, LLP in Woodland Hills, California, can speak on the subject of asset protection & privacy for an entire day, but for a recent small breakfast meeting of valley CPAs and business managers, he managed, using examples from the OJ Simpson case, to give a nice overview of the topic, in just under an hour.

The Goldman family has been unable to collect much of the money that was awarded to them by the judge in the wrongful death case against OJ Simpson. So, it looks strange to most observers when they see the aerial news photos of OJ’s Florida home, and photos of him enjoying a nice round of golf. It looks like he has plenty of money. So, why can’t the Goldmans collect?

Before delving into the topic, Mr. Stein made sure to clarify two initial points. The first point is that asset protection isn’t about secretly hiding assets overseas, through sham transactions. There has been much speculation in legal circles that Mr. Simpson’s defense attorneys over-billed him for his legal fees and stashed away some money for him, overseas. The Goldman family’s attorneys are very good, and they have found no evidence that this has actually happened. If it had occurred, it would be an illegal act, and at a minimum, his attorneys would be risking their licenses. Proper asset protection is about openly using common legal entities to make assets within those entities judgment proof. A creditor may be able to see all of the settlor’s assets, but he would still be unable to force a transfer, even after winning a civil judgment. This is the position that the Goldmans find themselves vis-à-vis OJ Simpson.

The second point is that there is a difference between privacy and asset protection. Actions taken to keep a property owner’s name out of the public record may succeed in providing a reasonable level of privacy from the general public, but those privacy measures won’t withstand a vigorous discovery process by an aggressive civil litigation attorney.

Privacy

Celebrities and wealthy individuals have very particular privacy interests when purchasing a home. They need to keep their names out of the public record and away from potential stalkers, obsessed fans, kidnappers and other troublemakers.

Normally, when someone purchases a home, the county records the buyer’s name, an address for tax billing and the transfer tax amount (which can be used to estimate the property’s sales price.) The county gets this information from the grant deed.

The key to keeping one’s name and the purchase price of one’s home out of the public record is to make sure neither appears on the grant deed.

The simplest way to keep one’s name private is to purchase the home in the name of a trust. A trust is a private contract that appoints a trusted friend or attorney as the trustee. His job is to look after the beneficiary’s assets. The beneficiary would be the individual using the trust to obscure his ownership. The name of the trust would appear on the county records, and if the trust has a non-descriptive name, like the “Sunshine Trust”, it would adequately protect the privacy of the beneficiary. The county will also ask for an address to send the tax bill. Just be careful to use an address that doesn’t betray the identity of he homebuyer.

Anyone searching the tax roll can also estimate the price paid for any given property, by dividing the amount of the transfer tax by the tax rate. If a homebuyer doesn’t want the purchase price made public, just instruct escrow not to include the transfer tax on the grant deed. It doesn’t have to be included. Make a note on the grant deed where it asks for the transfer tax amount, “See attachment & don’t record the tax.” Include the necessary attachment, and the county will not record the tax.

What about personal property? A boat? Cars? How does one keep one’s name out of the vehicle registry? Mr. Stein recommends holding these assets though a limited liability company (LLC.) The vehicle registry will show the name of the LLC, only. The Secretary of State’s records will only show the name and address of the agent for service of process for the LLC. Many principals choose their attorney to act in this capacity, and they record his office address as the corporate address, as well. For most purposes, this provides and adequate level of privacy.

Asset Protection

Besides merely providing privacy, entities such as qualified pension plans, LLCs and trusts can also be used to protect property from creditors & legal judgments. Because Mr. Stein was speaking to a fairly sophisticated audience, there wasn’t much need to explain the basic nature or obvious advantages of these entities. He did, however, point out some of their lesser-known benefits.

When a creditor records a judgment with the county recorder’s office, a lien is automatically placed against all of the real property held in his name in that county. The creditor doesn’t need to know the whereabouts of any of the he debtor’s properties.

If real estate holdings are transferred into one or more limited liability companies (LLCs) and out of the individual’s name, the judgment lien would not attach to such properties.

Let’s say the creditor is more aggressive. He may have already discovered that the property owner controls his assets through a LLC, and he may have asked for and received a charging order from the court. This would entitle him to claim any disbursements from the LLC. It’s unlikely, though, that creditor would go through the time and expense of pursuing such an order, because the LLC’s management (i.e., the debtor) would simply elect to suspend disbursements. Obtaining a charging order in this situation would be pointless, and the creditor’s attorneys would probably tell him so.

When we do see a creditor actually pursue a charging order against an LLC, it is usually when there is more than money at stake. It’s usually because there is personal animosity between the parties: such as between the Goldmans and Mr. Simpson. To protect oneself from an extreme situation like this, a property owner could elect to include a “poison pill” clause in the LLC’s operating agreement. Such a clause would stipulate that in the event of the attachment of any member’s disbursements, the other members have the right to buyout his interests for some nominal amount. This would make any charging order virtually worthless.

Limited partnerships don’t provide this same protection, because the general partner has control over when disbursements are made, not the limited partners. Mr. Stein recommends holding limited partnership interests in the name of an LLC, to achieve a desirable level of asset protection.

Now, here is the most interesting part. Since the owner of the LLC controls this entity though his ownership of an LLC interest, can’t the creditor ask the judge to attach these shares? Well, the answer is, “No.” By statute, interests in an LLC are not attachable.

Contrast this with shares in corporations, which are attachable.

Though there are many types of structures and techniques offering a variety of asset protection advantages, the allotted time wasn’t sufficient for our asset protection expert to adequately discuss them all. He did, however, make the point that most people are hesitant about entering into an irrevocable trust. It’s not in most people’s nature to commit to something that is “irrevocable.” For the purposes of asset protection, a settlor must use an irrevocable trust. The term “irrevocable” means that creditors may not revoke the trust though legal action, but it does not mean that the organizers of a properly drafted trust would not be able to revoke.

Revocable trusts provide settlors with no protection from creditors.

Trusts should also include a spendthrift provision that prohibits the beneficiary from voluntarily or involuntarily assigning his interests in the trust, and it should be a discretionary trust, in which the trustee has discretion to make distributions. Obviously, one should also appoint a friendly trustee.

Okay, back to OJ. How is it that his football pension income is somehow magically off-limits to the Goldmans? Well, it turns out that this is a universal feature of any ERISA qualified retirement plan, such as a 401k.

Jacob recalled an anecdote about a very thrifty embezzler whose ill-gotten gains couldn’t be attached because he had already transferred the funds into his ERISA qualified retirement plan.

IRAs do not qualify as ERISA plans, and do not offer the same level of protection, and sometimes, none at all.

Transferring ownership of liquid assets to an offshore LLC or trust is another way of shielding cash and securities, but it is not exactly bulletproof. If a creditor can convince a US court that the settlor controls these foreign entities, the judge may issue an order to the settlor or the financial institution to surrender any funds in those accounts. In these circumstances, if the financial institution is located in the US, it will most certainly comply.

To avoid this possibility, it would be better if the liquid assets were not just in the name of a foreign entity but also deposited into a foreign financial institution that has no branches or subsidiaries in a US jurisdiction. This would provide the maximum protection.

Fraudulent Transfers

Anyone considering taking steps like these to protect assets should be warned that if the assets are not transferred into a trust, LLC or other entity properly, a court may find the transaction to be a fraudulent transfer. This is certainly a possibility if the asset transfers are made after a lawsuit is filed. It’s always better to make asset protection arrangements long before any threat presents itself.

Other Considerations

|

Drew de la Houssaye is an associate with THE BROKERAGE Real Estate Group Beverly Hills. Drew specializes in westside luxury real estate, renovations and probate sales. He blogs on Westside real estate, entertainment and local events. If you would like to contact him, he can be reached via twitter, facebook, LinkedIn or email. |

Credits

Powered by WordPress

Design by Graph Paper Press

Subscribe to entries

Subscribe to comments

2026 by Drew de la Houssaye – Realtor ©